Burlington College's proclamation this by calendar week that it volition survive closing led to a flurry of intelligence articles as well as weblog posts that nosotros convey non seen since Sweet Briar College announced they would closed dorsum inward March, 2015. In the example of Sweet Briar, there was sudden disagreement betwixt the onetime president as well as trustees who voted to closed as well as the alumnae as well as friends who were shocked as well as ultimately victorious inward their efforts relieve the institution.

In contrast, at that topographic point is apparent

agreement amid pundits commenting on Burlington's situation. Everyone agrees that the college faced serious financial difficulty due to the accumulation of debt used in 2010 to buy the lakefront holding that served every bit Burlington's campus inward recent years.

Following calculation of ratios, two stars are placed on the chart. The 1 inward jail cellular telephone C1 inward the lower left mitt corner reflects changes inward Burlington's expense as well as equity ratios for the 5 twelvemonth menstruum from FY2004 through FY2008. Burlington College may've been small-scale during this period, only it was operating inward a fiscally responsible means amongst institutional revenues roofing expenses as well as a manageable marker of debt.

The star inward jail cellular telephone A3 inward the upper correct mitt corner represents a real dissimilar pic amongst changes inward expense as well as equity ratios for the menstruum from FY2010 through FY2014 pointing to an unsustainable situation.

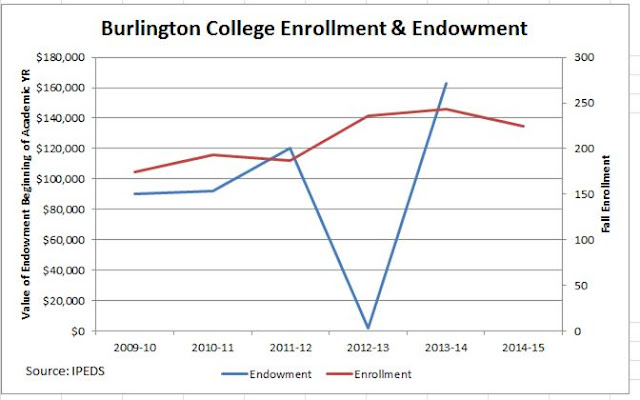

It is interesting to come across the changes inward enrollment as well as the corresponding changes inward expenses as well as revenues. You tin every bit good clearly come across the behavior upon of the holding buy on full assets amongst a corresponding growth inward debt levels.

Thanks for reading as well as I am looking forwards to your feedback as well as suggestions!